Price of Sand Per Ton in Nigeria Today 2025

The price of sand per 1 trip in Nigeria depends on whether it’s sharp sand, filling sand, plaster sand and soft sand. Sand is an essential component in building construction.…

Average Cost of Third Party Vehicle Insurance in Nigeria 2025

The cost of third party vehicle insurance has become a daily inquiry because the government has made it compulsory. Insurance companies like Leadway, AIICO, IEI, and Allianz are all into…

Price of Sanitary pads in Nigeria 2025

The price of sanitary pads depends on the brand. Besense sanitary pads are among the best and in the list of the top 10 in Nigeria. Molped sanitary pads are…

Price of Castor Oil in Nigeria 2025

The price of castor oil in pharmacy is less expensive than other non-pharmaceutical stores. Castor oil is an oil extracted from the castor bean seed. It is an essential oil…

Dangote Cement Price in Nigeria 2025

Dangote Cement factory sells at wholesale prices. Dangote cement prices vary based on location. The price of 50kg Dangote cement depends on the location. Different locations sell at different prices.…

Cost of Hiring a Trailer in Nigeria 2025

The cost of hiring a trailer in Nigeria depends on the total tonnage. There are reputable companies that hire trucks located in Lagos Nigeria. Whether you want to hire Howo…

Price of Cashew Nuts in Nigeria today 2025

The international price of cashew nuts in Nigeria today is at an all-time high due to economic instability. Cashew nuts are cash crops and important raw materials in so many…

Pricelist of Iron Rods Per Ton in Nigeria 2025

The price of iron rods per ton in Nigeria depends on the size. Various iron rod sizes are available for sale in the Nigerian market, including 8mm, 10mm, 12mm, and…

Price of Used 40 Feet and 20 Feet Containers in Nigeria 2025

The price of used 40 feet and 20 feet containers in Nigeria depends on the quality. There are used containers for sale in Lagos, Abuja, Ibadan, Port Harcourt etc. There…

Full makeup kit list with price in Nigeria 2025

The full makeup kit is normally bought by makeup artists, spa therapists, and other professional services that require women’s beauty. There is a professional makeup list and a makeup list…

Price of Bambara Nuts (Okpa Seed) in Nigeria 2025

The price of bambara nuts in Nigeria depends on the location where you’re buying from. The Bambara Nuts is a legume that is called Okpa seed in Nigeria. This nut…

Price of Tecno Spark 10 Pro in Nigeria 2025

Tecno Spark 10 Pro’s price in Nigeria is depends on the memory capacity. There are 8GB 128GB RAM and 8GB, 256GB internal memory capacities. Knowing the prices of a phone…

Price of Beans in Nigeria Today 2025

The price of beans in Nigeria depends on the quantity you’re buying and the location. Beans is sold per kg, and in cups. Beans are packaged in bags of 50kg,…

Price of Yuan to Naira in the Black Market February 2025

The current price of Yuan to Naira in the black market today February 14th 2025, is higher than the official rate. As we all know, the black market price is…

Current Price of Basket of Tomatoes in Nigeria 2025

The average price of basket of tomatoes in Nigeria depends on the quantity and location. Tomatoes are cheaper to buy in the northern part of Nigeria. In Lagos, it’s cheaper…

Price of Crate of Eggs in Nigeria Today 2025

The price of crate of eggs in Nigeria today has gone up. Three years ago, 1 crate of eggs was sold for 1,300 naira, but today, it has seen a…

Elephant Cement Price in Nigeria 2025

Elephant Cement Price in Nigeria is higher than Dangote cement price. The price of Elephant cement per bag in Lagos, Abuja, Port Harcourt, and other Nigerian states where they have…

Price of Semovita and Semolina in Nigeria 2025

Different Semovita and Semolina brands have different prices. The price of semovita in Nigeria depends on the brand, quality and quantity. Semovita is packaged in 1kg, 2kg, 2.5kg, 5kg and…

Black Market Fuel Price in Nigeria Today 2025

Black market fuel price in Nigeria is determined by the seller because it has no fixed price due to its illegal nature. Living in Nigeria undoubtedly familiarizes you with the…

PVC Roofing Sheets Price in Nigeria 2025

The price of PVC roofing sheets in Nigeria is dependent on the thickness and designs. Selecting the right building materials can sometimes be a difficult task. You can buy PVC…

Price of 50kg Bag of Garri in Nigeria 2025

The price of 50kg bag of garri in Nigeria depends on the location. The price of bag of garri in Lagos isn’t same in Ibadan, Owerri, Benue, Benin etc. Garri…

Black Market Price of Pounds to Naira (GBP) Today in Lagos, Abuja, Nigeria

The black market price of pounds to naira today February 14th 2025, is something everyone dealing with foreign currency should be familiar with. Aboki in Lagos, Abuja, Ibadan, Umuahia, Owerri…

Wigs and Hair Attachment Price in Nigeria 2025

The price of hair attachment, weavons and hair wigs in Nigeria today depends on the quality. Hair attachments with natural human hair are very expensive and can only be afforded…

Black Market Price of Dollar to Naira Today in Lagos, Abuja, Nigeria

As we can see on the streets of Lagos as of today February 14th 2025, the current black market price of Dollar to Naira is still very high and this…

Price of Palm Oil Per Litre in Nigeria 2025

The price of red palm oil depends on the quality and the quantity you want to buy. Palm oil is packaged in 25 litres, 10 litres, 5 litres and 1…

Second-Hand Clothes: Price of Okrika Bale Clothes in Nigeria 2025

Okrika Bale Clothes business is one of the most lucrative businesses you can venture into as a Nigerian. As you know, the Okrika bale business involves buying and selling secondhand…

Price of Refilling Cooking Gas Per Kg/Ton in Nigeria 2025

You’ll agree with me that the price of refilling cooking gas per kg in Nigeria depends on the capacity of the gas cylinder. There are 3kg, 5kg, 6kg, 10kg, 12kg,…

Price of Yam Tubers in Nigeria 2025

The price of yam tubers in Nigeria depends on the size. There are big yam tubers, medium yam tubers and small yam tubers. Yam Tubers is a major food in…

Cement Prices in Nigeria Today 2025

Several factors determine wholesale cement prices in Nigeria. Popular cement brands include Dangote, BUA, Larfarge/Elephant cement, Ibeto cement. They are sold at different prices, slightly different from each other. Cement…

Price of Tecno Spark 9 in Nigeria 2025

The Price of Tecno Spark 9 in Nigeria today depends on the internal memory capacity. You’ll agree with me that the prices of goods are not so stellar in Nigeria…

Current Price of Bag of Rice in Nigeria 2025

The current price of 50kg bag of rice in Nigeria today depends on whether it’s local Nigerian rice of foreign rice. In Nigeria, rice is being sold per bag, per…

Wholesale Price of Ankara in Nigeria 2025

Wholesale price of Ankara in Nigeria is far cheaper than the retail price. There are different types of Ankara fabrics having different designs. A bundle of Ankara contains different latest…

NNPC fuel pump price in Nigeria per Litre 2025

NNPC fuel pump price in Nigeria per Litre 2025 as we already know affects the daily lives of citizens, businesses, and not only that the country’s overall economy. The constant…

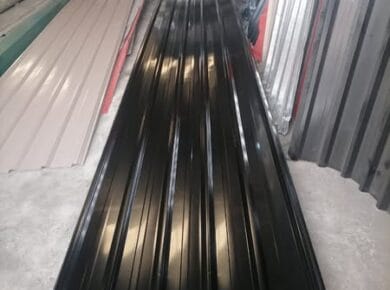

Price of Cameroon Roofing Sheets in Nigeria 2025

The price of Cameroon Roofing sheets in Nigeria is dependent on the type of material, the designs, the brand, and the thickness. Original cameroon roofing sheet has a thickness of…

Price of Fuel in Nigeria Today Per Litre 2025

The price of fuel in Nigeria today depends on the company you’re purchasing it from. One important thing you need to take note of is that Fuel are not just…

Long Span Aluminium Roofing Sheets Price in Nigeria 2025

Long span aluminium roofing sheets price in Nigeria depends majorly on thickness per square meter. Long span aluminium roofing sheets are unique due to its durability. Aluminium roofing sheets are…

Price of 6 inches and 9 inches Blocks in Nigeria 2025

The price of 6 inches and 9 inches Blocks in Nigeria varies and it is greatly dependent on the Price of sand, price of cement, size and location. The difference…